Why NRO Account Transfers Require Extra Care

For NRIs, the Non-Resident Ordinary (NRO) account is the primary account used to receive income earned in India—such as rent, dividends, pensions, or proceeds from asset sales. While operating an NRO account is straightforward for receiving funds, transferring money out of it—whether within India or abroad—comes with regulatory and tax considerations that are often misunderstood.

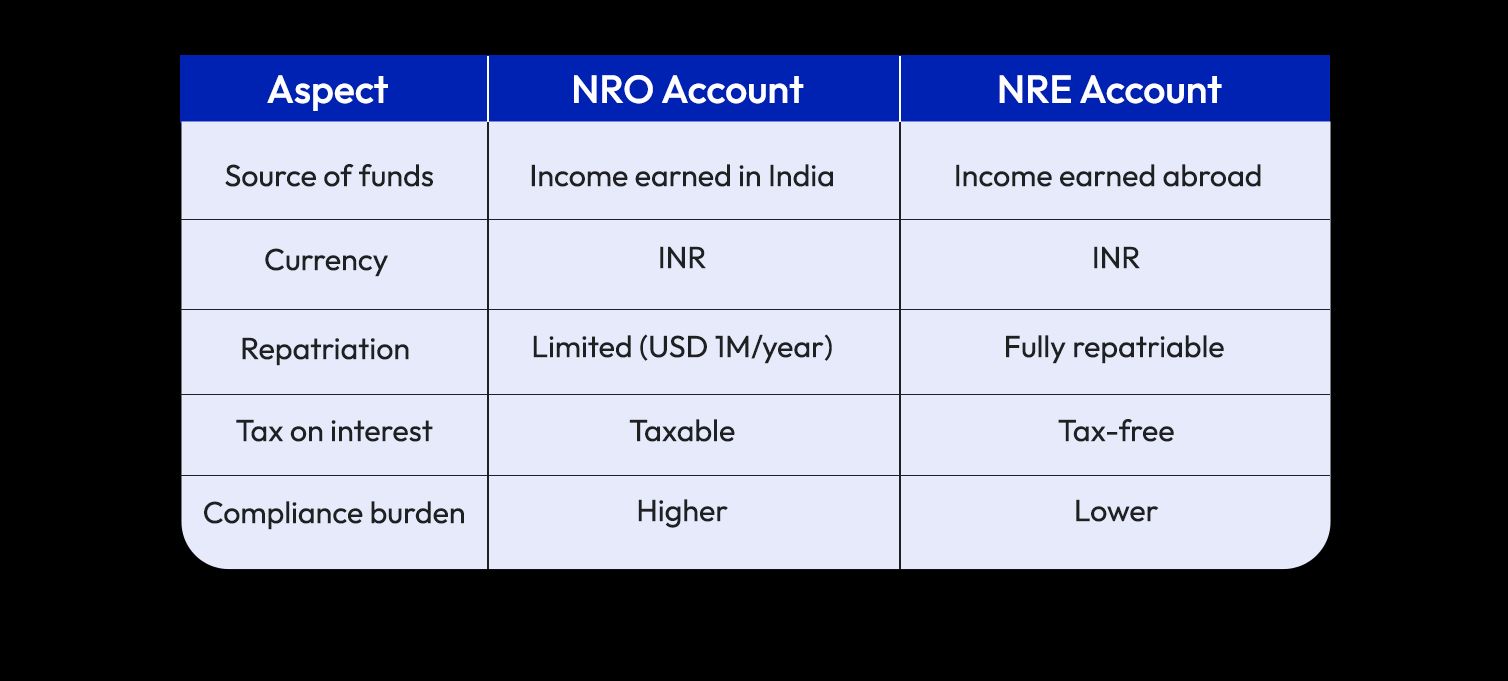

Unlike NRE or FCNR accounts, NRO accounts are subject to tighter controls because the funds originate in India. Understanding these controls is critical for NRIs to avoid blocked transfers, compliance issues, or unnecessary delays.

What Is an NRO Account Used For?

An NRO account is designed to manage India-sourced income for non-residents. Typical credits to an NRO account include rental income, interest, dividends, pension payments, and sale proceeds of assets located in India.

Key characteristics of an NRO account include:

- It can be held as a savings, current, or fixed deposit account

- It is maintained in Indian rupees

- It can receive both resident and non-resident credits

- Interest earned is taxable in India

Types of Transfers from an NRO Account

Transfers from an NRO account generally fall into two categories: domestic transfers within India and outward transfers (repatriation).

Transfers Within India

Funds in an NRO account can be freely transferred:

- To another NRO account

- To a resident Indian account (subject to purpose and compliance)

These transfers are relatively simple but still subject to tax compliance if the funds represent taxable income.

Transfers Outside India

Outward transfers from an NRO account are regulated and subject to limits, documentation, and tax clearance.

Repatriation Limits from NRO Accounts

One of the most important rules NRIs must understand is the annual repatriation cap.

NRIs can repatriate:

- Up to USD 1 million per financial year

- This limit applies to the aggregate of all eligible NRO balances, not per transaction

The limit covers:

- Income earned in India

- Sale proceeds of assets

- Inherited funds

Unused limits cannot be carried forward to future years.

Tax Compliance Before Transferring Funds

Tax compliance is mandatory before funds can be transferred from an NRO account, especially for outward remittances.

Banks typically require confirmation that:

- Applicable tax has been paid or deducted at source

- Necessary declarations have been submitted

This often involves:

- Form 15 CA (self-declaration of tax compliance)

- Form 15CB (chartered accountant certificate, where applicable)

Without these documents, banks will not process outward transfers.

This distinction explains why NRO transfers are more tightly regulated.

Common Scenarios Involving NRO Transfers

NRIs typically transfer funds from NRO accounts when:

- Moving accumulated rental income abroad

- Transferring proceeds after selling property

- Consolidating inherited funds

- Sending money to family members within India

Each scenario may involve different documentation and tax considerations, even though the account type remains the same.

Common Mistakes NRIs Make with NRO Transfers

Many NRIs run into issues because they:

- Assume NRO funds are freely repatriable

- Ignore tax obligations before initiating transfers

- Misunderstand the USD 1 million annual limit

- Delay documentation until after requesting a transfer

These mistakes often lead to rejected or delayed transactions.

FAQs: NRO Account Transfers

Can funds be freely transferred from an NRO account abroad?No. Outward transfers are subject to an annual limit and tax compliance.

Is interest earned on NRO accounts taxable?Yes. Interest is taxable in India and subject to TDS.

Can NRO funds be transferred to an NRE account?Yes, subject to tax compliance and repatriation rules.

Are Form 15CA and 15CB always required?Requirements depend on the nature and amount of the transfer.

Can the USD 1 million limit be increased?No. The limit is fixed per financial year.

Final Thoughts

NRO accounts play a vital role in managing India-sourced income for NRIs, but transferring funds from these accounts requires careful attention to regulatory and tax requirements. The combination of repatriation limits, tax compliance, and documentation makes advance planning essential.

For NRIs, understanding how NRO transfers work is key to ensuring that money earned or accumulated in India can be accessed and moved smoothly—without regulatory surprises or unnecessary delays.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.