Why NRIs Often Get Stuck on TRN-Related Issues

Many NRIs encounter delays or confusion during banking, remittance, or tax-related processes in India because of one overlooked detail: the Transaction Reference Number (TRN). While it may seem like a simple tracking code, the TRN plays a critical role in ensuring traceability, compliance, and reconciliation of financial transactions.

Problems arise when NRIs are unable to locate a TRN, misunderstand its purpose, or assume it is interchangeable across systems. In reality, TRNs are context-specific and are used differently by banks, tax authorities, and remittance systems. Understanding how TRNs work helps NRIs resolve transaction issues faster and avoid repeated follow-ups.

What Is a TRN?

A Transaction Reference Number (TRN) is a unique identifier generated for a specific financial transaction. It allows institutions to track, verify, and reconcile Payments across system.

Depending on context, a TRN may be generated for:

- Bank transfers

- Tax payments

- Remittance transactions

- Regulatory filings

Each TRN is unique to the transaction and serves as proof that a transaction was initiated or completed.

Why TRNs Are Important for NRIs

For NRIs, TRNs are especially important because many transactions are cross-border or compliance-heavy. A missing or incorrect TRN can delay:

- Credit of funds to an Indian bank account

- Confirmation of tax payments

- Resolution of failed or pending transfers

- Regulatory verification during audits

Because NRIs often operate across time zones and institutions, the TRN becomes the fastest way to trace a transaction without ambiguity.

Common Situations Where NRIs Are Asked for a TRN

NRIs are most commonly asked for a TRN in the following situations:

- When a remittance is delayed or marked as pending

- When a bank needs to trace an inward transfer

- When confirming tax payments made online

- When reconciling account statements

In these cases, providing the correct TRN helps institutions locate the transaction quickly.

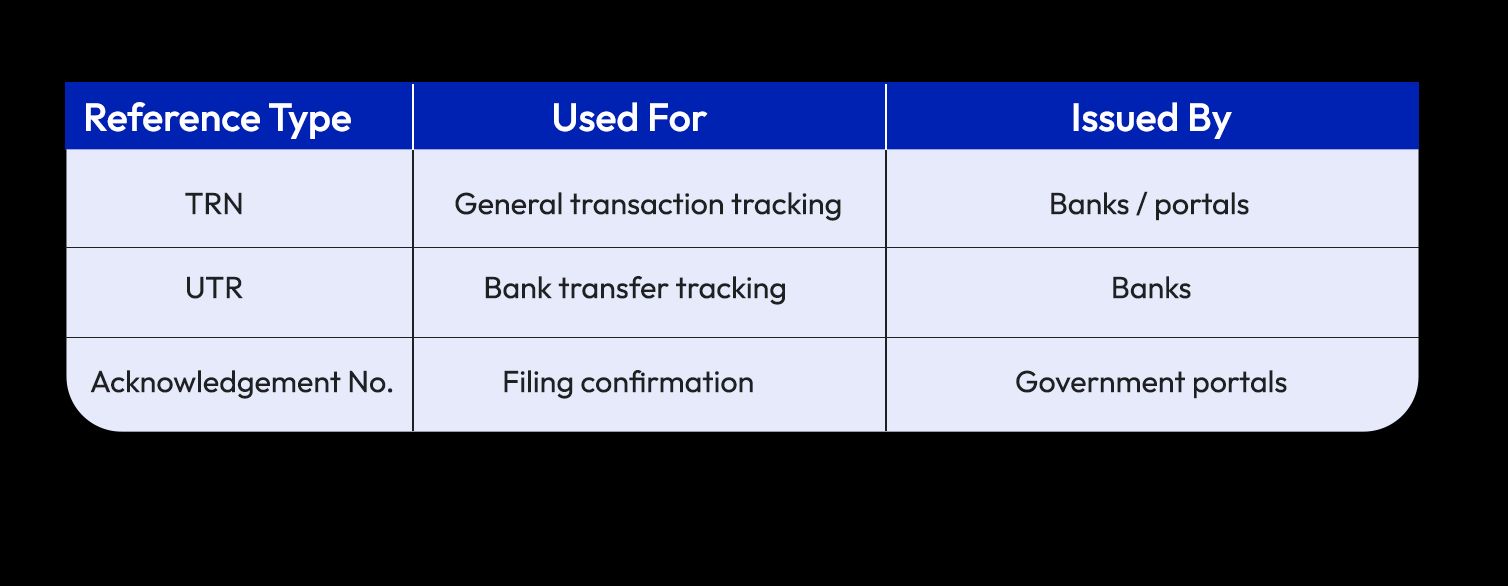

TRN vs UTR vs Acknowledgement Number

One common source of confusion is the assumption that all reference numbers are the same. They are not.

Understanding which number applies to which process avoids unnecessary back-and-forth.

Common TRN-Related Problems NRIs Face

NRIs frequently encounter issues such as:

- Losing access to the platform where the TRN was generated

- Sharing the wrong reference number with banks

- Assuming a TRN guarantees transaction completion

- Confusing provisional TRNs with final confirmations

These misunderstandings can delay resolution even when the transaction itself is valid.

How NRIs Can Locate a Missing TRN

If a TRN is misplaced, NRIs can usually retrieve it by:

- Checking email or SMS confirmations

- Logging into the original transaction platform

- Reviewing bank statements or transaction history

- Contacting customer support with transaction details

Keeping digital records of transaction confirmations is strongly recommended.

Best Practices to Avoid TRN Issues

NRIs can reduce friction by:

- Saving confirmation pages after every transaction

- Keeping screenshots or PDFs of payment receipts

- Recording TRNs alongside transaction purpose and date

- Avoiding reliance on verbal confirmations

These small steps significantly reduce resolution time during disputes.

FAQs: TRN for NRIs

Is a TRN the same as a UTR?No. A UTR is specific to bank transfers, while TRN is a broader reference term.

Can a transaction be traced without a TRN?Sometimes, but it takes longer and requires additional details.

Does receiving a TRN mean the transaction is complete?Not always. Some TRNs are generated at initiation, not completion.

How long should NRIs keep TRN records?At least until the transaction is fully settled and reconciled.

Who generates the TRN?The platform or institution processing the transaction.

Final Thoughts

For NRIs, the Transaction Reference Number is more than a technical detail—it is the backbone of transaction traceability across borders. Understanding what a TRN represents, when it is required, and how to use it correctly can save significant time and frustration.

In cross-border financial interactions, clarity and documentation matter. Treating TRNs as essential records rather than disposable confirmations helps NRIs navigate banking and compliance processes with confidence.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.