Understanding NRI Status in a Globalised World

As millions of Indians live, work, and study abroad, the term NRI is widely used but often misunderstood. Whether you are sending money home, investing in India, or filing taxes, your NRI status directly affects your financial rights and obligations.

In this guide by ScopeX, we explain what NRI means, how it is defined under Indian law, and why understanding your status is essential for managing money across borders.

What Does NRI Mean?

NRI stands for Non-Resident Indian.

An NRI is an Indian citizen who resides outside India for employment, business, education, or any purpose that indicates an intention to stay abroad for an uncertain period.

This classification is determined primarily by residential status under Indian tax laws, not by citizenship alone.

Source: Income Tax Department of Indiahttps://www.incometax.gov.in/iec/foportal/help/individual/residential-status

How Is NRI Status Determined?

The 182-Day Rule

Under the Income tax Act, 1961, an individual is considered a resident of India if:

- They stay in India for 182 days or more in a financial year, or

- They stay in India for 60 days in the current year and 365 days in the previous four years

If neither condition is met, the individual is classified as an NRI.

For Indian citizens leaving India for employment or as crew members, the 60-day condition

is relaxed, making it easier to qualify as an NRI.

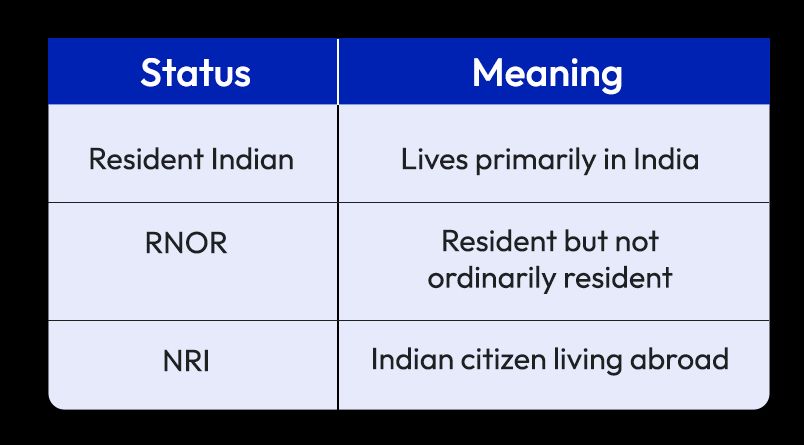

RNOR status often applies to returning NRIs and offers partial tax benefits during the transition.

Why NRI Status Matters Financially

Your residential status impacts multiple aspects of your financial life.

Taxation

NRIs are taxed in India only on income earned or accrued in India. Income earned abroad is not taxable in India.

Banking

NRIs are required to use designated accounts such as:

- NRE accounts

- NRO accounts

- FCNR accounts

Each account type has different rules related to taxation and repatriation.

How NRI Status Impacts Money Transfers

For NRIs, sending money to India is often linked to family support, investments, or long-term savings.

Understanding NRI status ensures:

- Compliance with FEMA Regulations

- Correct usage of NRE or NRO accounts

- Smooth repatriation of funds

ScopeX is built specifically for NRIs, offering transparent rates, fast transfers, and compliance-ready remittances designed for cross-border financial needs.

Common Misconceptions About NRI Status

- Holding an OCI card automatically makes you an NRI

- Paying taxes abroad removes Indian tax obligations

- NRI status is permanent once obtained

In reality, NRI status is assessed every financial year based on physical presence in India.

FAQs: NRI Meaning and Status Explained

1. Is NRI status based on passport or residence?

NRI status is determined by the number of days spent in India, not by passport or visa type.

2. Can an NRI earn income in India?

Yes. NRIs can earn income in India such as rent, interest, and capital gains, all of which may be taxable.

3. Do NRIs need to file income tax returns in India?

NRIs must file returns if they have taxable Indian income or wish to claim refunds.

4. Does NRI status affect money transfers?

Yes. It determines account eligibility, repatriation rules, and compliance requirements.

5. Can NRI status change?

Yes. If the number of days spent in India exceeds the prescribed limits in a financial year, residential status changes.

Final Thoughts

Understanding NRI status is essential for compliant and efficient financial planning. From taxation to remittances, clarity on your residential classification helps you make informed decisions.

With ScopeX, NRIs get a money transfer experience designed around transparency, speed, and regulatory clarity—built for life across borders.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.