Why Transaction Tracking Is Harder for NRIs

For NRIs, money transfers are rarely confined to a single banking system. A typical transfer may involve a foreign bank, an intermediary correspondent bank, and an Indian receiving bank—each with its own systems, timelines, and reference numbers. When everything works smoothly, the process feels invisible. But when a transfer is delayed, partially credited, or flagged for compliance, tracking it becomes significantly more complex.

Many NRIs struggle not because the money is lost, but because they don’t know where in the chain the transaction is stuck, which reference number to use, or which institution to contact. Understanding how transaction tracking works across borders is essential for resolving issues quickly and avoiding unnecessary stress.

How Cross-Border Money Transfers Actually Move

An international transfer does not move directly from one account to another. Instead, it passes through multiple systems.

In most cases:

- The sender’s bank initiates the transfer

- One or more intermediary (correspondent) banks route the funds

- The recipient’s bank credits the final account

Each step generates its own internal records, which is why tracking requires more than a single confirmation message.

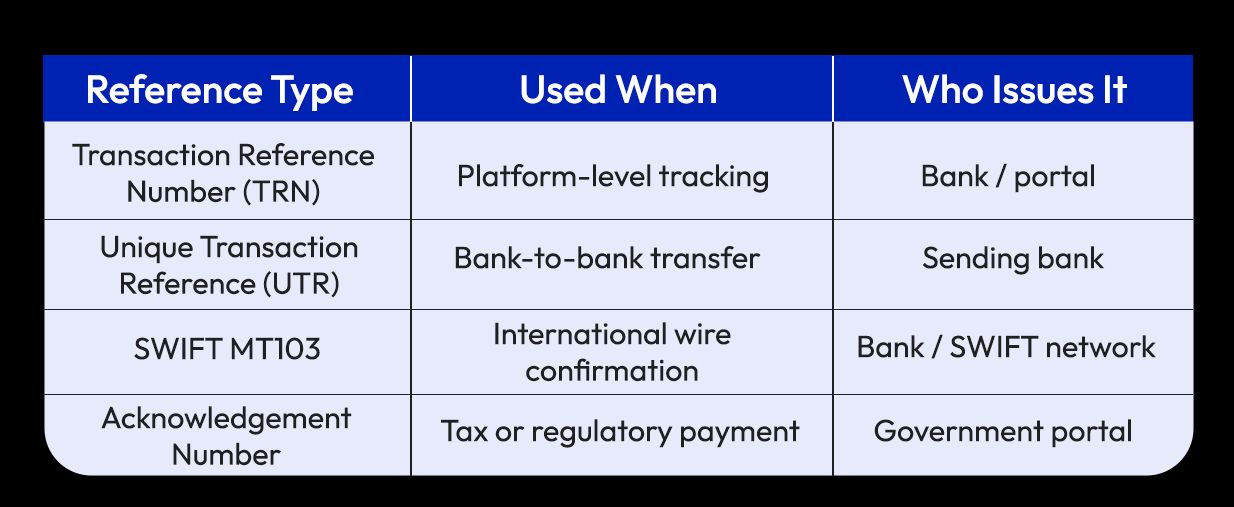

The Key Reference Numbers Used in Tracking

One of the biggest challenges NRIs face is knowing which reference number to use at which stage.

Providing the wrong reference often delays resolution, even if the transaction itself is valid.

When a Transfer Is Delayed: What It Usually Means

A delayed transfer does not automatically mean a failed transfer. In most cases, delays occur due to:

- Compliance or AML checks

- Incomplete beneficiary details

- Time-zone differences between banks

- Public holidays in one of the countries involved

Banks rarely cancel transfers without notice. More often, the funds are temporarily held for verification.

How NRIs Should Track a Delayed Transaction Step by Step

When a transfer does not arrive on time, the most effective approach is sequential.

First, the sender should confirm whether the transfer has been successfully debited from the originating account. If yes, the next step is to obtain the UTR or SWIFT MT103 from the sending bank. This document confirms that the funds have left the sender’s bank and entered the international payment network.

Once this is available, the receiving bank in India can trace the transaction internally using the same reference. Without this information, the receiving bank often cannot locate the transaction, even if it is already in process.

Why Banks Ask for Additional Information

NRIs are sometimes surprised when banks ask for documents even after a transfer is initiated. This usually happens when:

- The transaction amount is higher than usual

- The purpose of remittance is unclear

- Regulatory thresholds are crossed

In such cases, banks may request:

- Proof of source of funds

- Purpose declaration

- Identity or account verification

These checks are routine and are meant to ensure regulatory compliance.

Common Tracking Mistakes NRIs Make

Many delays are prolonged due to avoidable mistakes. These include:

- Contacting the receiving bank before obtaining the UTR or SWIFT

- Assuming a confirmation email means final credit

- Sharing screenshots instead of official references

- Waiting too long before escalating

Understanding the tracking hierarchy helps reduce unnecessary back-and-forth.

How Long Should NRIs Wait Before Escalating?

While timelines vary, a general guideline is:

- Domestic transfers: 1–2 working days

- International transfers: 2–5 working days

- High-value or flagged transfers: Longer, depending on compliance

If a transfer exceeds standard timelines, escalation with complete reference details is appropriate.

FAQs: Tracking NRI Money Transfers

Does a successful debit mean the transfer is complete?

No. Debit only confirms initiation, not final credit.

Is the UTR the most important reference number?

For bank-to-bank tracking, yes. It is the primary identifier.

Can the receiving bank trace a transfer without a UTR?

Usually no. Tracking without it is slower and less reliable.

What is a SWIFT MT103 used for?

It is an international wire confirmation that proves the transfer was sent.

Can transfers be reversed if delayed?

Only in limited cases and usually before final credit.

Final Thoughts

For NRIs, tracking money transfers is less about chasing banks and more about understanding how cross-border payment systems operate. Knowing which reference to use, when to escalate, and how to communicate clearly with financial institutions can dramatically reduce resolution time.

In international banking, information—not urgency—is what moves transactions forward. Keeping accurate records and understanding the tracking process empowers NRIs to resolve issues calmly and efficiently.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.