Why TRCs Matter More Than Most NRIs Expect

For NRIs earning income from India, the Tax Residency Certificate (TRC) often appears suddenly—usually when a bank, tenant, buyer, or tax advisor asks for it at the last minute. Many NRIs assume it is a generic document or believe it applies only to high-income individuals. In reality, the TRC plays a specific and powerful role in determining how cross-border income is taxed.

The TRC is not a tax benefit by itself. Instead, it is a gateway document that allows NRIs to access treaty benefits under Double Taxation Avoidance Agreements (DTAA). Without it, Indian payers are usually required to deduct tax at higher domestic rates, even when a treaty provides relief.

What Is a Tax Residency Certificate?

A Tax Residency Certificate is an official document issued by the tax authority of the country where an individual is considered a tax resident. It certifies that the person is liable to tax in that country for a given financial year.

For NRIs, the TRC typically:

- Confirms tax residency outside India

- Specifies the relevant tax year

- Identifies the issuing tax authority

India recognises TRCs issued by foreign tax authorities for the purpose of applying DTAA benefits.

When Do NRIs Actually Need a TRC?

A TRC is required only when an NRI wants to claim DTAA benefits. It is not mandatory for every transaction.

NRIs typically need a TRC when:

- Receiving rental income from India

- Earning interest on NRO deposits

- Selling property or financial assets

- Receiving professional or consultancy income from India

- Claiming reduced TDS rates under a tax treaty

If DTAA relief is not being claimed, a TRC may not be required—but this often results in higher tax deduction.

TRC and TDS: How They Are Connected

In most NRI transactions, the payer in India is responsible for deducting tax. Without a TRC, the payer usually applies domestic tax rates, which are often higher and include surcharge and cess.

When a valid TRC is provided:

- DTAA rates may apply

- Lower withholding may be permitted

- Cash flow improves significantly

However, the TRC must be submitted before or at the time of payment. Submitting it later usually does not reverse TDS already deducted.

What Information Must a TRC Contain?

Indian tax law specifies minimum details that must appear on a TRC, including:

- Name of the taxpayer

- Status (individual, company, etc.)

- Nationality or country of incorporation

- Tax identification number

- Period of tax residency

If certain details are missing, additional declarations (such as Form 10F) may be required.

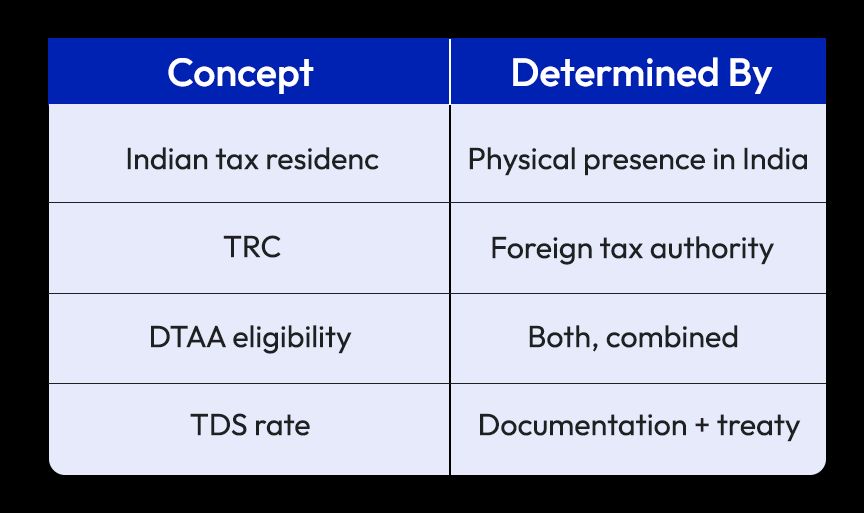

TRC vs Residential Status Under Indian Tax Law

A common misconception is that holding a TRC automatically makes someone a non-resident for Indian tax purposes. This is not true.

The TRC supports DTAA claims but does not override India’s residential status rules on its own.

How NRIs Obtain a TRC

The process for obtaining a TRC depends entirely on the country of residence. Some countries issue TRCs automatically upon request, while others require a formal application or tax filing.

Typically, NRIs must:

- Apply through the local tax authority

- Specify the tax year

- Provide proof of residence or tax filings

Processing times vary widely, so advance planning is essential.

Common TRC-Related Mistakes NRIs Make

NRIs often:

- Apply for a TRC after income is paid

- Assume last year’s TRC is valid indefinitely

- Submit incomplete TRCs without required details

- Believe DTAA benefits apply automatically

These errors usually result in higher TDS and delayed refunds.

FAQs: Tax Residency Certificate for NRIs

Is a TRC mandatory for all NRIs?

No. It is required only when claiming DTAA benefits.

Can one TRC be used for multiple transactions?

Yes, if it covers the relevant financial year.

Does a TRC eliminate tax in India?

No. It may reduce tax but does not always eliminate it.

Can NRIs submit a TRC after TDS is deducted?

Usually no. DTAA relief must be claimed upfront.

Is Form 10F required along with a TRC?

Sometimes, if the TRC lacks certain details.

Final Thoughts

For NRIs, the Tax Residency Certificate is not just a compliance formality—it is a strategic document that directly impacts taxation, cash flow, and refund timelines. Understanding when it is required, how it interacts with TDS, and when to submit it can prevent unnecessary tax leakage.

In cross-border taxation, timing and documentation matter as much as tax rates. A TRC, obtained and used correctly, is often the difference between efficient tax treatment and prolonged refund cycles.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.