Why Section 195 Matters for NRIs and Payers

Section 195 of the Income Tax Act, 1961 is one of the most important—and frequently misunderstood—tax provisions affecting NRIs. It governs tax deduction at source (TDS) on payments made to non-residents, covering a wide range of transactions such as rent, interest, professional fees, royalties, and capital gains.

For NRIs, Section 195 often results in high upfront TDS, even when the actual tax liability is lower. For payers in India, non-compliance can lead to penalties and disallowance of expenses. Understanding how Section 195 works is essential for both sides of the transaction.

What Is Section 195?

Section 195 of Income Tax Act requires any person responsible for making a payment to a non-resident to deduct income tax at source if the payment is chargeable to tax in India.

Key aspects of Section 195 include:

- It applies only to non-residents and foreign companies

- TDS is required at the time of credit or payment, whichever is earlier

- Deduction is mandatory only if the income is taxable in India

The phrase “sum chargeable under the provisions of the Act” is central to how Section 195 is interpreted.

Types of Payments Covered Under Section 195

Section 195 applies to a broad range of payments, including:

- Rent paid to NRIs for property in India

- Interest on loans or deposits (primarily NRO accounts)

- Fees for technical or professional services

- Royalty payments

- Capital gains arising from sale of Indian assets

It does not apply to income that is not taxable in India.

When Is TDS Required Under Section 195?

TDS under Section 195 is required when:

- The recipient is a non-resident, and

- The payment is taxable in India

If a payment is not taxable in India, no TDS is required—even if the recipient is an NRI. However, determining taxability is often complex and requires careful analysis.

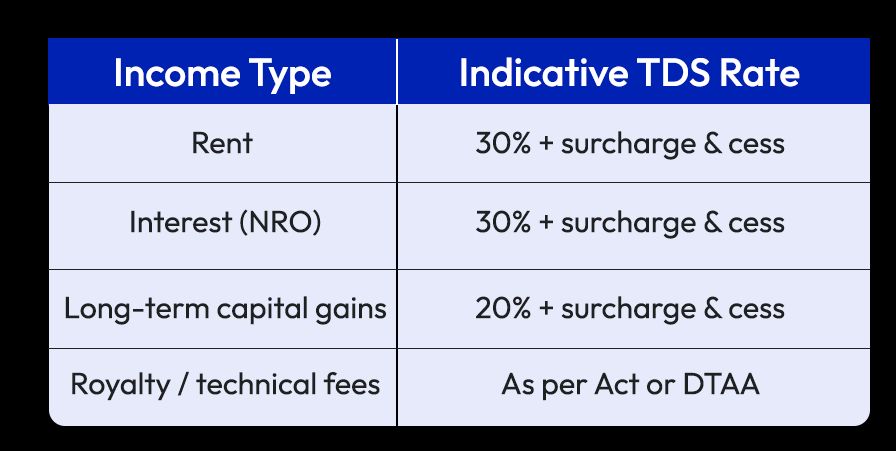

TDS Rates Under Section 195

Unlike domestic TDS provisions, Section 195 does not prescribe a fixed rate. Instead:

- TDS is deducted at the rate applicable to the nature of income

- Rates may include surcharge and cess

- DTAA rates may apply if beneficial

DTAA and Section 195

If India has a Double Taxation Avoidance Agreement (DTAA) with the NRI’s country of residence, lower TDS rates may apply.

To claim DTAA benefits:

- A Tax Residency Certificate (TRC) is required

- Form 10F must be submitted

- DTAA provisions must be more beneficial than domestic law

Without documentation, payers usually deduct tax at higher domestic rates.

Lower or Nil TDS Under Section 197

NRIs can apply for a lower or nil TDS certificate under Section 197 if their actual tax liability is lower than the prescribed TDS.

This is particularly useful for:

- Property sales

- Large rental income

- Transactions involving capital gains

Once approved, the payer deducts tax at the reduced rate specified in the certificate.

Common Compliance Mistakes

Frequent errors include:

- Deducting TDS on non-taxable payments

- Ignoring DTAA provisions

- Applying incorrect rates

- Failing to deposit or report TDS correctly

Such mistakes can result in penalties, interest, and litigation.

FAQs: Section 195 Explained

Does Section 195 apply to all payments made to NRIs?No. It applies only to payments that are taxable in India.

Who is responsible for deducting TDS under Section 195?The payer in India is responsible for deducting and depositing TDS.

Can DTAA override Section 195 rates?Yes. DTAA provisions apply if they are more beneficial and properly documented.

What happens if excess TDS is deducted?NRIs can claim a refund by filing an Indian income tax return.

Is Section 195 applicable to capital gains?Yes. TDS applies on payments involving capital gains from Indian assets.

Final Thoughts

Section 195 plays a critical role in ensuring tax compliance on payments made to NRIs. While the provision is broad and conservative, understanding its scope, rates, and available relief mechanisms can significantly reduce unnecessary tax deductions.

For NRIs and Indian payers alike, clarity on Section 195 is essential to avoid disputes, manage cash flow efficiently, and remain compliant with Indian tax laws.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.