Why OCI Status Is Often Misunderstood

For many overseas Indians, the Overseas Citizen of India (OCI) card is seen as a near-equivalent to Indian citizenship. While the OCI framework does offer extensive privileges, it is not citizenship—and the differences matter more in practice than most people realise.

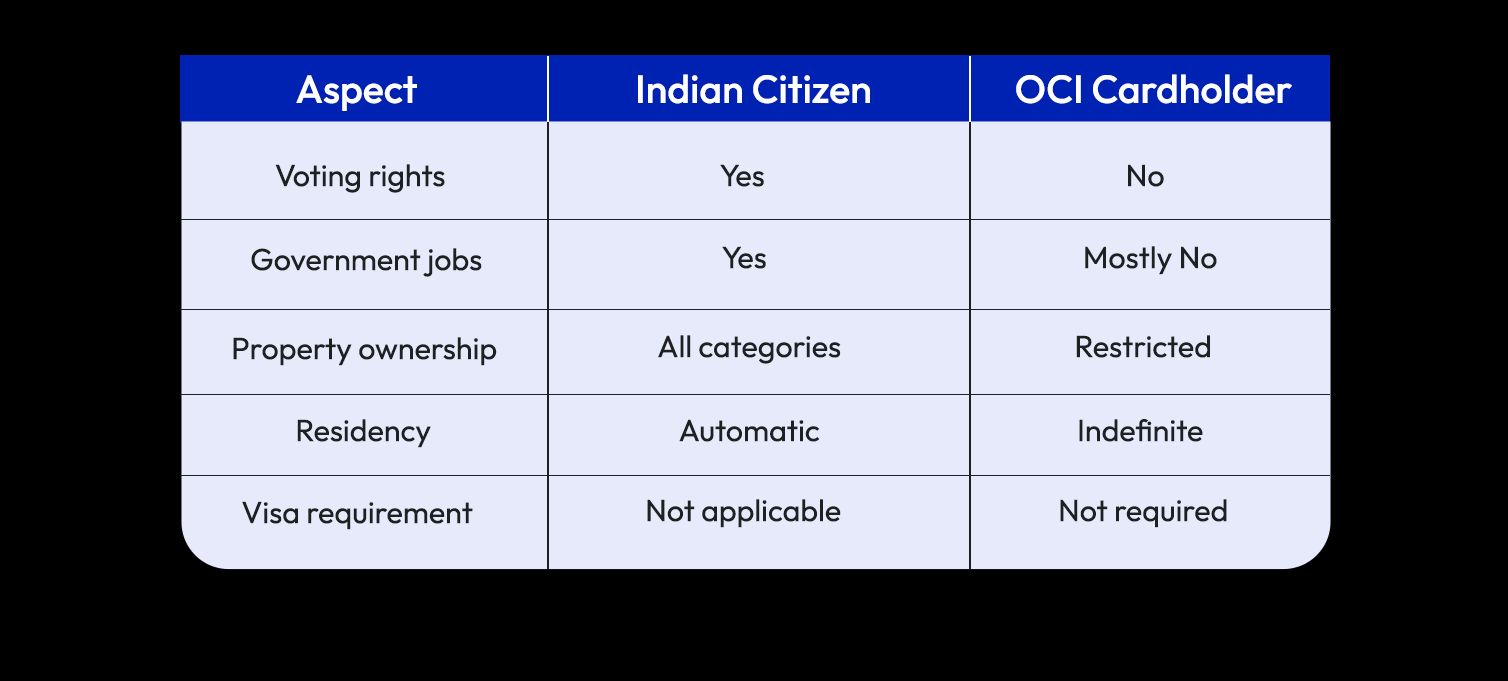

OCI status sits in a middle ground: more rights than a foreign national, but fewer than an Indian citizen. The confusion arises because OCI benefits span travel, residency, property ownership, and economic activity, while restrictions are concentrated in specific but important areas such as political participation and government employment. Understanding these boundaries helps OCI cardholders avoid unintentional violations and plan long-term life decisions in India more effectively.

What Is OCI Status?

OCI is a form of long-term residency and privilege status granted to foreign citizens of Indian origin. It allows eligible individuals to live in India indefinitely without the need for a visa and grants parity with NRIs in several economic and financial matters.

OCI Status is governed by the Citizenship Act, 1955, and subsequent notifications issued by the Government of India.

What OCI Cardholders Are Allowed to Do in India

OCI cardholders enjoy a wide range of rights that make long-term residence and engagement with India easier.

They are permitted to:

- Enter and exit India freely without a visa

- Live in India without time restrictions

- Work in most private-sector roles

- Open and operate NRO and NRE bank accounts

- Invest in Indian financial instruments under NRI norms

- Own residential and commercial property (with exceptions)

In many everyday scenarios—banking, renting property, employment—OCI cardholders are treated on par with NRIs.

Key Restrictions OCI Cardholders Must Know

Despite broad privileges, OCI status comes with clear legal limitations.

OCI cardholders are not permitted to:

- Vote in Indian elections

- Contest elections or hold public office

- Work in government jobs (with limited exceptions)

- Purchase agricultural land, plantation property, or farmhouses

- Hold constitutional positions

These restrictions are non-negotiable and are enforced strictly.

Property Ownership: A Common Grey Area

Property ownership is one of the most misunderstood areas for OCI cardholders. While they can freely purchase residential and commercial property, certain categories remain prohibited.

OCI cardholders cannot purchase:

- Agricultural land

- Plantation property

- Farmhouses

However, they may inherit such properties under Indian succession laws, subject to applicable regulations.

This distinction—purchase versus inheritance—is critical and often overlooked.

This comparison highlights why OCI status, while powerful, is not a substitute for citizenship.

Employment and Professional Practice

OCI cardholders are allowed to work in India in most private-sector roles. However, regulated professions such as law, medicine, or architecture may require additional approvals from professional bodies.

In recent years, certain relaxations have been introduced, but OCI professionals must still comply with sector-specific regulations before practicing in India.

Financial and Tax Implications for OCI Cardholders

From a financial perspective, OCI cardholders are generally treated at par with NRIs:

- Tax residency is determined by physical presence, not OCI status

- Indian-source income is taxable in India

- Investment and repatriation rules follow NRI norms

OCI status does not automatically confer tax residency or tax exemptions.

Common Mistakes OCI Cardholders Make

OCI holders often:

- Assume voting or political rights apply

- Purchase restricted property unknowingly

- Confuse tax residency with OCI status

- Ignore professional licensing requirements

These errors usually arise from treating OCI as “dual citizenship,” which India does not allow.

FAQs: OCI Rights and Restrictions

Is OCI the same as dual citizenship?

No. India does not recognise dual citizenship.

Can OCI cardholders live in India permanently?

Yes. There is no time limit on stay.

Can OCI holders work in India?Yes, in most private-sector roles.

Can OCI cardholders buy any property in India?

No. Agricultural land and farmhouses are prohibited.

Does OCI status affect tax liability?

No. Tax depends on residential status, not OCI status.

Final Thoughts

OCI status offers overseas Indians a powerful connection to India, enabling long-term residence, economic participation, and cultural continuity. However, it is not a blanket substitute for citizenship. The rights it grants are broad, but the restrictions—especially around political participation and property—are precise and enforceable.

For OCI cardholders, clarity is the key to confidence. Understanding not just what is allowed, but where the boundaries lie, ensures smoother personal, financial, and legal decision-making in India.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.