Why Non-PIS Accounts Matter for NRIs

NRIs who invest in Indian financial markets often come across the term PIS (Portfolio Investment Scheme). While PIS accounts are mandatory for certain types of equity investments, not all NRI investments require them. In many cases, NRIs can invest using a Non-PIS account, which follows a different regulatory framework and offers greater flexibility for specific investment needs.

Understanding when a Non-PIS account is required—and how it differs from a PIS account—helps NRIs invest compliantly, avoid unnecessary restrictions, and choose the right banking structure.

What Is a Non-PIS Account?

A Non-PIS account is an NRI bank account used for investments in India that do not fall under the RBI’s Portfolio Investment Scheme. These accounts are typically linked to either an NRE or NRO account, depending on the source of funds and repatriation needs.

Non-PIS accounts are commonly used for:

- Investing in mutual funds

- Buying shares on a non-repatriation basis

- Investing in IPOs (non-PIS route)

- Purchasing bonds, debentures, and government securities

Unlike PIS accounts, Non PIS account are not subject to RBI-mandated investment ceilings for equity markets.

What Is the Portfolio Investment Scheme (PIS)?

The Portfolio Investment Scheme (PIS) is an RBI framework that allows NRIs to invest in Indian equity shares and convertible debentures on a repatriation or non-repatriation basis through recognised stock exchanges.

Under PIS:

- Each NRI must designate one bank branch for all equity trades

- Banks report transactions to the RBI

- Investments are subject to sectoral and individual caps

Because of these restrictions, PIS accounts are required only for Secondary market equity trading on Indian stock exchanges.

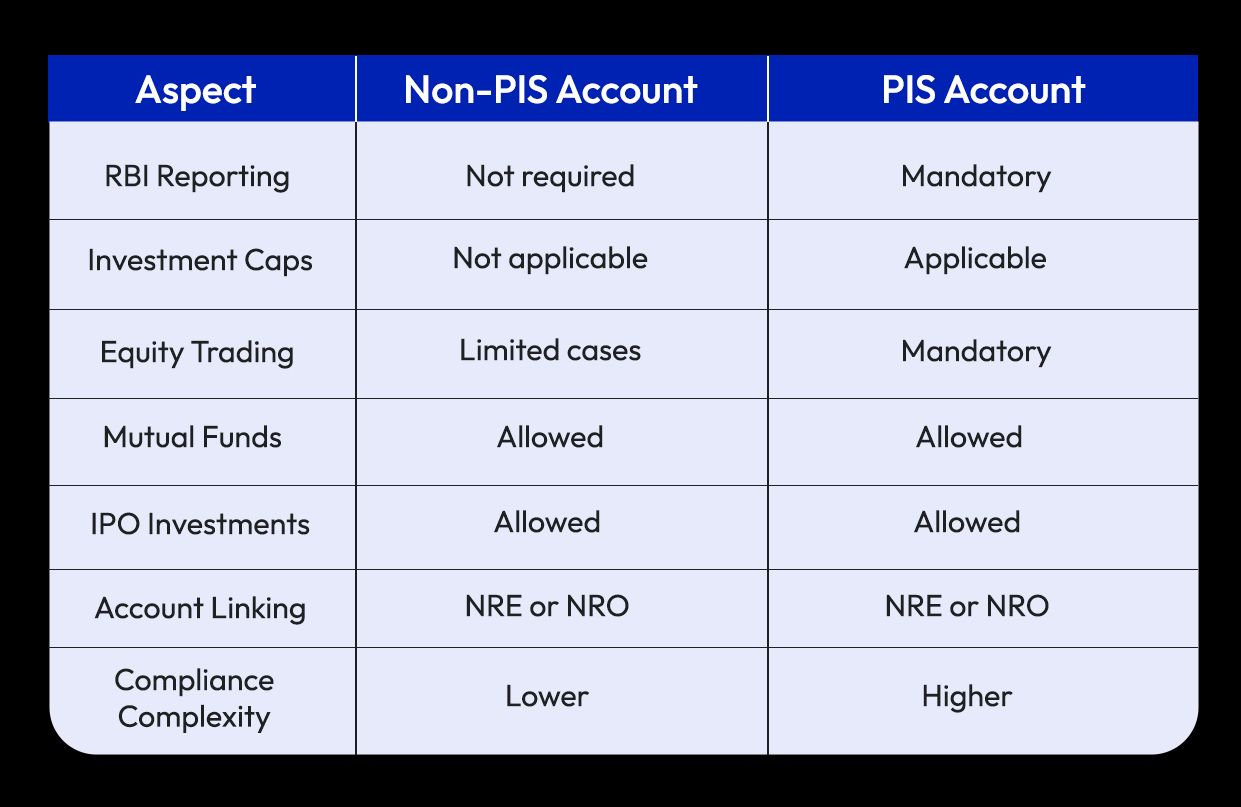

Non-PIS vs PIS Accounts: Key Differences

This distinction is crucial for NRIs who invest primarily in mutual funds or long-term instruments, rather than active equity trading.

When Do NRIs Need a Non-PIS Account?

NRIs typically use Non-PIS accounts when:

- Investing in mutual funds

- Buying shares through IPO or FPO routes

- Investing on a non-repatriation basis

- Purchasing government securities or bonds

For these investments, RBI does not require the PIS framework, making Non-PIS accounts sufficient and simpler.

Repatriation Rules for Non-PIS Investments

Repatriation depends on the underlying account type:

- NRE-linked Non-PIS account: Investments and returns are generally repatriable

- NRO-linked Non-PIS account: Repatriation subject to the USD 1 million annual limit and tax compliance

NRIs must ensure taxes are paid before repatriating proceeds from investments.

Taxation of Investments Through Non-PIS Accounts

Tax treatment for NRIs remains the same regardless of whether investments are made via PIS or Non-PIS routes.

Key points include:

- Capital gains tax applies based on asset type and holding period

- TDS is deducted at source for NRIs

- DTAA benefits may be available, subject to documentation

Proper planning helps manage cash flow and avoid excess TDS.

Common Mistakes NRIs Make

NRIs often:

- Open a PIS account unnecessarily

- Use the wrong account type for repatriation needs

- Assume PIS is mandatory for all investments

- Overlook tax and compliance requirements

Understanding investment routes early prevents structural issues later.

FAQs: Non-PIS Accounts for NRIs

What does Non-PIS mean for NRIs?

It refers to investments made outside the RBI’s Portfolio Investment Scheme framework.

Can NRIs buy mutual funds using Non-PIS accounts?

Yes. Mutual fund investments do not require a PIS account.

Is a PIS account mandatory for IPO investments?

No. IPO investments can be made through Non-PIS routes.

Are Non-PIS investments repatriable?Repatriation depends on whether the linked account is NRE or NRO.

Can an NRI have both PIS and Non-PIS accounts?Yes. NRIs can maintain both, depending on their investment strategy.

Final Thoughts

Non-PIS accounts offer NRIs a simpler and more flexible route for many types of investments in India. By understanding when a PIS account is required and when it is not, NRIs can structure their finances more efficiently, reduce compliance complexity, and invest with greater confidence.

Choosing the correct investment route is not just about compliance—it is about long-term clarity and control.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.