Why DTAA Is Important for NRIs

Non-Resident Indians often earn income across more than one country. Salary, interest, dividends, capital gains, or rental income may be subject to tax in the country where it is earned as well as in India. Without safeguards, this can lead to the same income being taxed twice, significantly reducing net earnings.

To prevent this, India has entered into Double taxation avoidance agreement (DTAA) with several countries. Understanding how DTAA works helps NRIs reduce tax liability legally, remain compliant in both jurisdictions, and avoid unnecessary disputes with tax authorities.

What Is DTAA?

A Double Taxation Avoidance Agreement (DTAA) is a bilateral treaty between two countries that determines how income earned across borders is taxed. The primary objective of DTAA is to ensure that income is taxed only once or that relief is provided where double taxation arises.

India has DTAA agreements with more than 90 countries, including the United States, the United Kingdom, Germany, Canada, Australia, and several European nations.

How Double Taxation Happens

Double taxation typically occurs when:

- Income is taxed in the country where it is earned (source country), and

- The same income is also taxed in the country where the individual resides (residence country)

For NRIs, this is common with income such as:

- Interest on bank deposits in India

- Dividends from Indian companies

- Capital gains from selling Indian assets

- Professional or consulting income

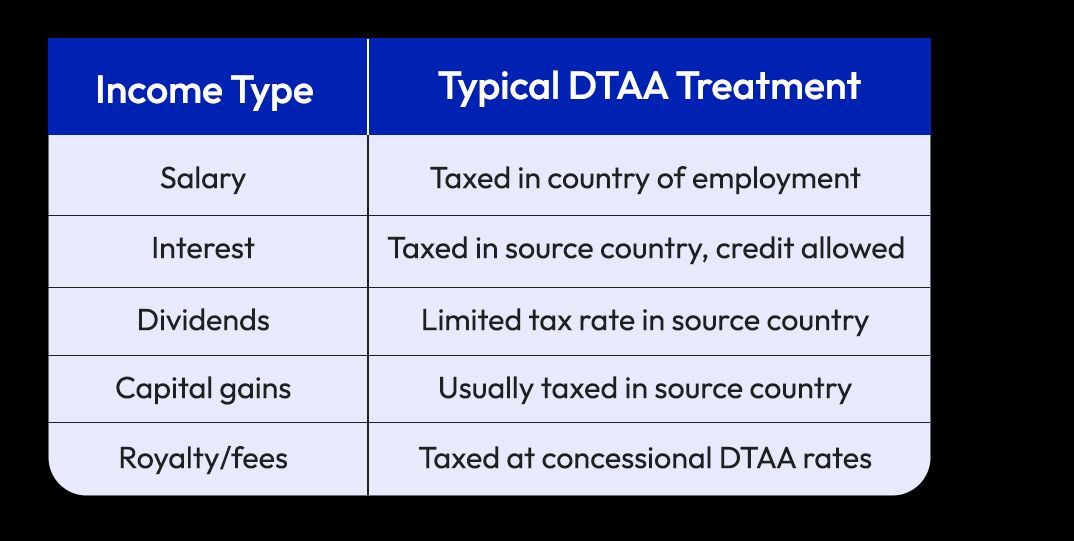

DTAA provisions determine which country has the right to tax each type of income.

Methods Used to Avoid Double Taxation

DTAA treaties generally use one of the following methods to provide relief.

Exemption Method

Under this method, income is taxed in only one country and exempted in the other. For example, certain income may be taxed only in the country of residence and exempt in India.

Tax Credit Method

Under this approach, income is taxed in both countries, but the taxpayer can claim a credit in the country of residence for tax paid in the source country.

Most of India’s DTAA agreements follow the Tax credit method.

Actual treatment depends on the specific DTAA agreement between India and the country of residence.

Claiming DTAA Benefits in India

To claim DTAA benefits in India, NRIs must fulfil certain compliance requirements.

These typically include:

- Obtaining a Tax Residency Certificate (TRC) from the country of residence

- Submitting Form 10f to Indian authorities

- Declaring DTAA applicability to the payer

Without these documents, Indian payers may deduct tax at higher domestic rates.

DTAA vs Domestic Tax Law: Which One Applies?

Under Indian tax law, NRIs are allowed to apply whichever is more beneficial—the provisions of the DTAA or the domestic Income Tax Act.

This means:

- If DTAA offers a lower tax rate, DTAA can be applied

- If domestic law is more favourable, domestic provisions may be used

This flexibility allows NRIs to optimise tax outcomes legally.

Common DTAA Misconceptions

Many NRIs assume that DTAA means no tax is payable in India. This is incorrect. DTAA does not eliminate tax automatically; it provides a framework to avoid double taxation, not taxation altogether.

Another misconception is that DTAA applies automatically. In reality, benefits must be actively claimed with proper documentation.

FAQs: DTAA for NRIs

Does DTAA mean I don’t have to pay tax in India?No. DTAA prevents double taxation but does not exempt income unless explicitly stated.

Is DTAA applicable to all types of income?Most income types are covered, but treatment varies by category and country.

What happens if I don’t submit a TRC?Without a TRC, Indian payers may deduct tax at higher domestic rates.

Can DTAA benefits be claimed every year?Yes, provided valid residency and documentation are maintained annually.

Do all countries have DTAA with India?No. India has DTAA agreements with many countries, but not all.

Final Thoughts

DTAA is one of the most important tax-relief mechanisms available to NRIs earning income across borders. By understanding how DTAA works, which income types are covered, and how to claim benefits correctly, NRIs can significantly reduce tax friction and remain compliant.

Careful documentation and awareness of treaty provisions ensure that income is taxed fairly—once, and in the right jurisdiction.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.