Why NRIs Need an Exit Strategy—Not Just Tax Knowledge

Most content around capital gains focuses on definitions, rates, and exemptions. While that information is important, it rarely answers the real question NRIs face:

“What should I do before I sell?”

For NRIs, selling assets in India—whether property, shares, or mutual funds—is not just a tax event. It is a multi-step financial process involving cash-flow planning, documentation, timelines, and regulatory coordination. Missing even one step can lead to blocked funds, excess tax deduction, or long refund cycles.

This guide focuses on capital gains planning as a process, helping NRIs think through the sale before it happens.

Step 1: Identify the Nature of the Asset You’re Selling

Before calculating tax, NRIs should clearly identify what kind of asset is being sold, because this determines almost everything that follows.

Key distinctions include:

- Immovable property vs financial assets

- Listed vs unlisted securities

- Repatriable vs non-repatriable investments

Each category has different holding periods, tax treatments, and compliance steps.

Step 2: Understand Cash-Flow Impact, Not Just Tax Rates

One of the biggest blind spots for NRIs is focusing on final tax liability instead of money actually received at the time of sale.

For NRIs:

- Tax is often deducted as TDS upfront

- Deduction may apply on the entire sale value

- Refunds may take months to process

This means that even if the final tax is modest, the immediate cash inflow can be significantly lower.

Planning question to ask:

Can I afford to wait for a refund, or do I need liquidity immediately?

Step 3: Decide Early Whether You Will Use Exemptions

Capital gains exemptions are powerful—but only if planned in advance.

Common reinvestment options include:

- Buying another residential property

- Investing in specified capital gains bonds

- Structuring timelines to meet reinvestment deadlines

What many NRIs miss is that exemptions are time-bound, and decisions often need to be made before the sale, not after.

Step 4: Consider Whether a Lower TDS Certificate Is Needed

For high-value transactions, especially property sales, NRIs often benefit from applying for a lower or nil TDS certificate.

This step:

- Must be completed before the sale

- Requires income estimates and documentation

- Can dramatically improve cash flow

Skipping this step usually means dealing with refunds later.

Step 5: Plan Repatriation Alongside the Sale

For NRIs intending to move funds abroad, it’s important to think beyond the sale itself.

Key considerations include:

- Which account will receive the sale proceeds (NRO or NRE)

- Annual repatriation limits

- Documentation required for outward transfers

Even fully legal transactions can be delayed if repatriation planning is left for later.

Step 6: Check DTAA Position—but Don’t Assume Exemption

DTAA can help reduce double taxation, but it does not automatically eliminate Indian tax.

NRIs should evaluate:

- Whether India retains taxing rights on the asset

- Whether DTAA offers tax credit or rate relief

- Documentation needed to claim benefits

DTAA planning is most effective when done before the transaction, not during filing season.

Step 7: Prepare Documentation in Advance

Delays often happen not because of tax rates, but because of missing paperwork.

Typical documents include:

- Purchase and sale agreements

- Proof of acquisition cost

- Tax payment records

- CA certificates where applicable

Having these ready before the sale closes reduces friction significantly.

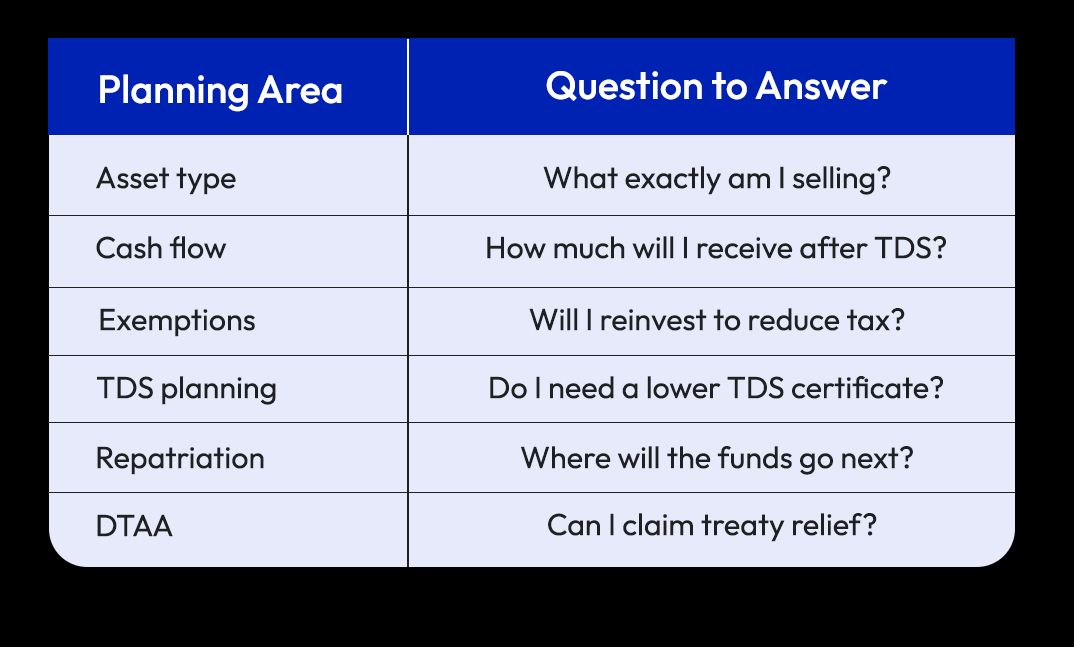

A Simple Pre-Sale Checklist for NRIs

FAQs: Capital Gains Planning for NRIs

Why should NRIs plan capital gains before selling?Because decisions made before the sale affect tax, cash flow, and compliance outcomes.

Is tax planning different from tax filing?Yes. Planning happens before the transaction; filing happens after.

Can NRIs change things after TDS is deducted?Limited changes are possible, but most flexibility is lost after deduction.

Is advance planning only needed for property sales?No. High-value financial assets also require planning.

Does professional advice really matter here?Yes. Small planning gaps can result in large cash-flow delays.

Final Thoughts

For NRIs, capital gains tax is not just about rates—it’s about sequence, timing, and structure. The most costly mistakes usually happen before the sale, not after.

Treating asset disposal as a planned financial exit, rather than a simple transaction, helps NRIs protect liquidity, reduce friction, and avoid long periods of uncertainty.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.