Why PPF Creates Confusion for NRIs

The Public Provident Fund (PPF) has long been one of India’s most trusted long-term savings instruments. Its government backing, tax benefits, and predictable returns make it especially popular among residents. However, for NRIs, PPF rules are far less straightforward.

Many Indians open PPF accounts while living in India and later move abroad for work or residence. At that point, questions begin to surface: Can an NRI continue a PPF account? Can contributions be made from abroad? Is the account still tax-free? Understanding how PPF works after a change in residential status is critical to avoid accidental non-compliance.

What Is PPF and Why It Matters

The Public Provident Fund is a long-term savings scheme introduced by the Government of India to encourage disciplined retirement planning. It comes with:

- A 15-year lock-in period

- Government-declared interest rates

- Tax benefits under Indian tax law

PPF is regulated under the Public Provident Fund Scheme, 2019 and managed by authorised banks and post offices.

Can NRIs Open a New PPF Account?

No. NRIs are not permitted to open new PPF accounts.

Once an individual becomes a non-resident under Indian tax law, they are no longer eligible to open a fresh PPF account. This restriction applies regardless of the country of residence.

This is one of the most important distinctions NRIs must be aware of—PPF is available only to resident Indians at the time of account opening.

What Happens to an Existing PPF Account After Becoming an NRI?

If a PPF account was opened while the individual was a resident Indian, it can be continued until maturity, even after the individual becomes an NRI.

However, there are important conditions:

- The account cannot be extended beyond the original 15-year maturity

- Contributions may continue only until maturity

- The account must be maintained in compliance with NRI rules

Failing to follow these conditions can lead to complications at the time of withdrawal.

Can NRIs Continue Contributing to PPF?

Yes, but with limitations.

NRIs may continue contributing to an existing PPF account until it matures, subject to:

- The annual contribution limits applicable to residents

- Contributions being made in Indian rupees

- Funds typically routed through an NRO account

However, once the account matures, NRIs cannot extend it for additional 5-year blocks, which is otherwise allowed for resident Indians.

Tax Treatment of PPF for NRIs

One of the biggest attractions of PPF is its tax efficiency, and this largely remains intact for NRIs.

Key tax points:

- Interest earned on PPF remains tax-free in India

- Withdrawals at maturity are not taxed in India

- Contributions may not qualify for tax deductions for NRIs under Section 80C

While Indian tax treatment is favourable, NRIs should also consider whether PPF interest is taxable in their country of residence.

Repatriation Rules for PPF Proceeds

PPF proceeds are repatriable, but with conditions.

Typically:

- Maturity proceeds are credited to an NRO account

- Repatriation abroad is subject to applicable RBI rules

- Transfers may fall under annual repatriation limits

NRIs should plan withdrawals and transfers carefully to avoid delays.

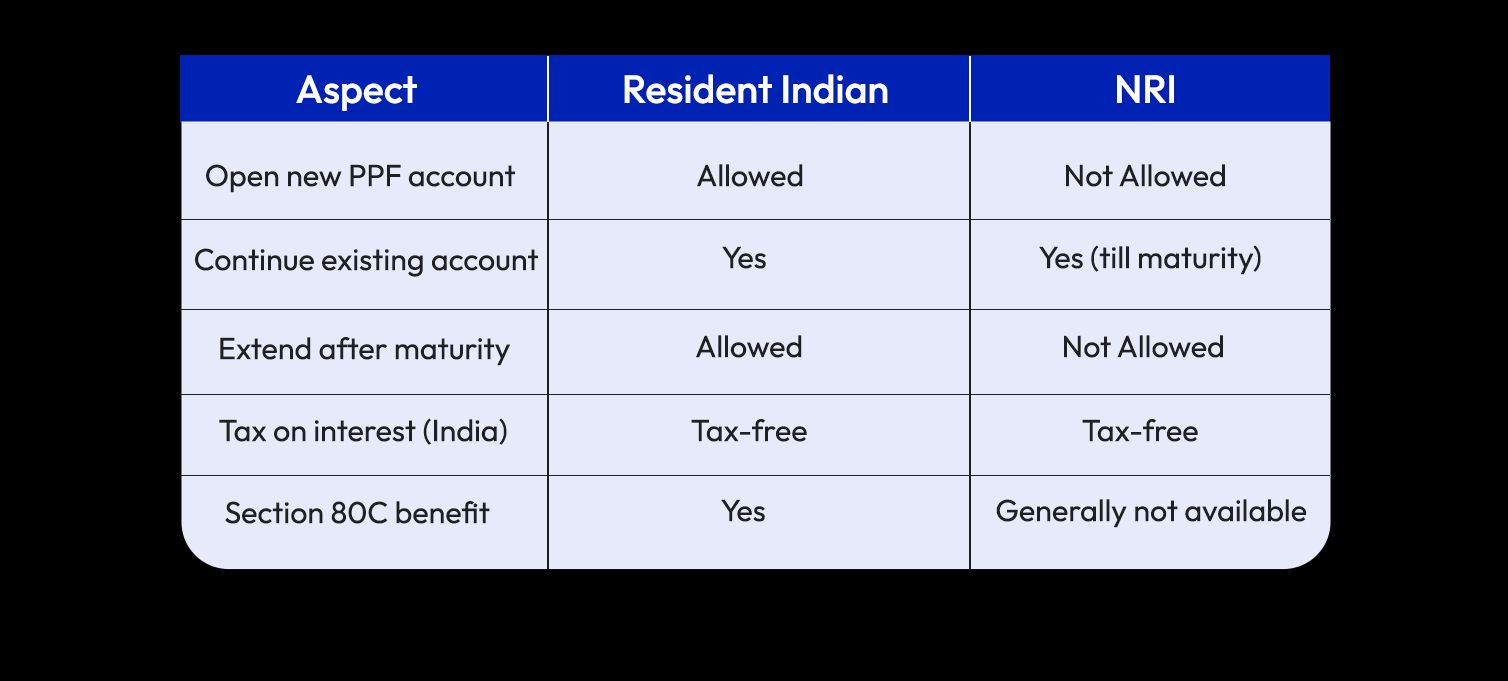

This comparison highlights why PPF planning should be revisited after a change in residency.

Common Mistakes NRIs Make with PPF

NRIs often:

- Attempt to open new PPF accounts after becoming non-resident

- Extend PPF accounts post-maturity incorrectly

- Assume tax treatment is identical in all countries

- Ignore repatriation planning

These mistakes usually surface only at maturity, when corrections are difficult.

FAQs: PPF for NRIs

Can an NRI open a new PPF account in India?No. NRIs are not permitted to open new PPF accounts.

Can NRIs continue contributing to an existing PPF account?Yes, but only until the original maturity date.

Is PPF interest taxable for NRIs?It is tax-free in India, but may be taxable in the country of residence.

Can NRIs extend a PPF account after 15 years?No. Extension is not permitted for NRIs.

Are PPF maturity proceeds repatriable?Yes, subject to RBI rules and annual limits.

Final Thoughts

PPF remains a valuable legacy savings instrument for NRIs who opened their accounts while living in India. However, it is not a flexible product once residency changes. Restrictions on new accounts, extensions, and tax deductions mean that NRIs must treat PPF as a finite, maturing asset, not a perpetual savings vehicle.

Understanding these limitations early allows NRIs to plan withdrawals, reinvestments, and cross-border transfers more effectively—without regulatory surprises at maturity.

Sources & Disclaimer

The information in this article is based on publicly available provider disclosures, marketing materials, industry reports, and general remittance market practices at the time of writing. Exchange rates, fees, transfer speeds, and availability may vary by country, payment method, bank, and time period.

Company names mentioned are included for illustrative and comparative purposes only. Any performance metrics, pricing examples, or user experiences referenced reflect advertised claims or individual reports and should not be treated as guarantees. Readers are encouraged to verify live rates, fees, and terms directly with the service provider before initiating a transfer.

This content is intended for informational purposes only and does not constitute financial advice, investment advice, or a recommendation of any specific service.